How Stampfeet increased customer engagement by 20% by connecting payment cards to its loyalty platform

With Asaf Rozin, CEO and co-founder at Stampfeet

The Goal

Create an easy and fast way for merchants to launch loyalty programs, while boosting end user engagement and spend.

The Results

- 366% increase in number of merchants added in the past year - up 5x from the previous year

- 41% average increase in number of transactions processed each month

- Website

- stampfeet.com

- Region

- US & UK

- Industry

- Loyalty

- Products

- Transactions API

Challenge

To make it easy and fast for merchants to launch loyalty programs and create a simple, frictionless way for end users to earn rewards.

Solution

Using Fidel API’s Select Transactions API, Stampfeet provides a way for merchants to launch loyalty programs within days, with no need for integrations and regardless of POS system. All while creating seamless end user experiences that increase engagement and keep customers returning.

A Growing Opportunity

CEO and co-founder of Stampfeet, Asaf Rozin, began to notice a growing opportunity.

Stampfeet is a customer loyalty platform that works across all aspects of loyalty, from initial strategy planning, all the way through to technical implementation. However, Asaf early on saw opportunities to grow and expand Stampfeet’s offerings, starting with the way their customers spent and earned rewards.

To improve the overall customer experience on his platform, Asaf knew he needed to start with how customers check-out. He sought to reward customers instantaneously for everyday spend however, he quickly realised retailers needed to integrate their Point of Sale (POS) systems to Stampfeet. This proved to be a challenge as many of the retail brands Stampfeet worked with had tens, even hundreds, of retail stores. Many retailers used different POS systems, meaning they would have to be integrated and maintained separately - a massive logistical feat and pressure on resources for both Stampfeet and its retail partners

Another difficulty of various POS systems is that it makes it difficult to track payment data in a meaningful way that drives customer insights. Any data that was being picked up and tracked by the POS systems was typically siloed, making it difficult to build a more comprehensive and omnichannel view of customer spend behaviour.

Lastly, and arguably most importantly, was that the checkout experience for customers was a multi-step process if they wanted to earn rewards for their spending. Receipt data had to be combined with a customer loyalty number, meaning customers had to show a loyalty card or scan a QR code at checkout. Asaf knew there must be a way to create a seamless process for Stampfeet users to earn rewards while they shop, without any additional friction at checkout.

The Solution | Smooth Sailing

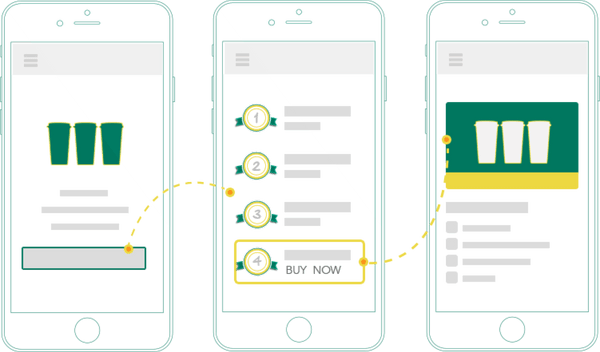

Stampfeet offers a simple solution for merchants to set up loyalty programs within a few days, with no integrations and regardless of POS system. With Fidel API acting as a connectivity layer, merchants working with Stampfeet can create easy, scalable and frictionless loyalty platforms by connecting payment cards to loyalty apps or programs.

By enabling loyalty programs that work at almost any merchant and POS system, Stampfeet’s loyalty programs are more scalable. In addition, Stampfeet and it’s merchant partners can better understand spend behaviour with real-time payment data. Tracking spend data is simple with Fidel API’s Select Transactions API and SDKs which connect user payment cards to loyalty programs or apps within seconds. With secure and tokenized spend data, Stampfeet and it’s merchant partners can better understand spend patterns and create more personalised end user experiences.

With just a few clicks, end users can connect payment cards to loyalty programs and automatically earn reward points while they spend. Plus, users can opt-in to receive real-time notifications of points and rewards earned. This means no more slow checkout processes where users have to scan plastic loyalty cards, QR codes, or pull up an app on their phone. Instead, users shop and pay normally with their cards and automatically earn rewards without any added friction.

“Thanks to our integration with Fidel API, we can now offer merchants and retailers an easy route to launch state of the art loyalty programs without any integration on their side.”

The Results | Making Strides

Asaf and his team have been happy to see positive results since partnering with Fidel API in 2018. In the past year, Stampfeet has seen a 366% increase in the number of merchant locations added to their programs, up 5x that from the previous year (2019 vs 2020).

In addition, on average Stampfeet has seen a 41% increase in number of transactions month-on-month (Jan2018-March2021) and an average of 211% increase in number of cards linked month-on-month (Jan2018-March2021).

What sets Stampfeet apart? Stampfeet’s ability to support omnichannel operations out-of-the-box is a huge benefit in a fragmented market. Traditional operations usually only cater to one channel (either online or offline) and require specific integrations for each. Asaf differentiates Stampfeet from the competition by offering both online and offline payment data through a single API. All while making it easy and fast for merchants to create loyalty programs that drive retention.

Stampfeet has its sights set on expanding and improving end user experiences across all of its programs. But what exactly Asaf has up his sleeve, we’ll have to wait and see!